Our Future Is SURE

Rated A, Exceptional, by Demotech, we're ready for what the future brings.

Our Commitment to You

Insurance is more than just a policy. It’s assurance that we’ll be there when times get tough. It’s a commitment to weather the storm with you. That’s why financial stability matters.

We’re rated A, Exceptional, by Demotech, Inc., heavily reinsured, and have strong capital reserves – proof that we’re ready for both everyday claims and widespread disasters.

- A, Exceptional, Financial Stability Rating®

- $1.5B+ Reinsurance Protection

- Millions in Extra Capital Support

SURE's Financial Stability Rating®

The independent financial rating agency Demotech, Inc. affirmed our Financial Stability Rating of A, Exceptional. What that means for you: it’s unbiased, third-party confirmation that we have the ability to pay claims and are committed to doing so.

Demotech assigns A ratings to insurers it believes can weather major economic downturns and losses while remaining solvent. It’s based on a strong balance sheet, quality and amount of reinsurance, and adequate loss reserves.

Our Reinsurance

Think of reinsurance as insurance for your insurance company. It spreads out risk to reduce the financial impact of big losses. We partner with leading reinsurers in the industry – ones that are very well capitalized and many that provide full collateral to support their capacity. Our reinsurance program ensures we have the ability to pay claims and help you recover quickly after a disaster.

Here are the highlights:

- Our catastrophe excess of loss (Cat XOL) program provides all-peril coverage for widespread single events, like a hurricane, wildfire, tornado, or winter storm.

- First-event reinsurance covers a 1-in-160 year loss, meaning SURE’s 2024 program limits can cover a major loss only expected to occur once in 160 years.

- SURE has sponsored six SEC 144A catastrophe bonds totaling more than $1 billion in multi-year capacity.

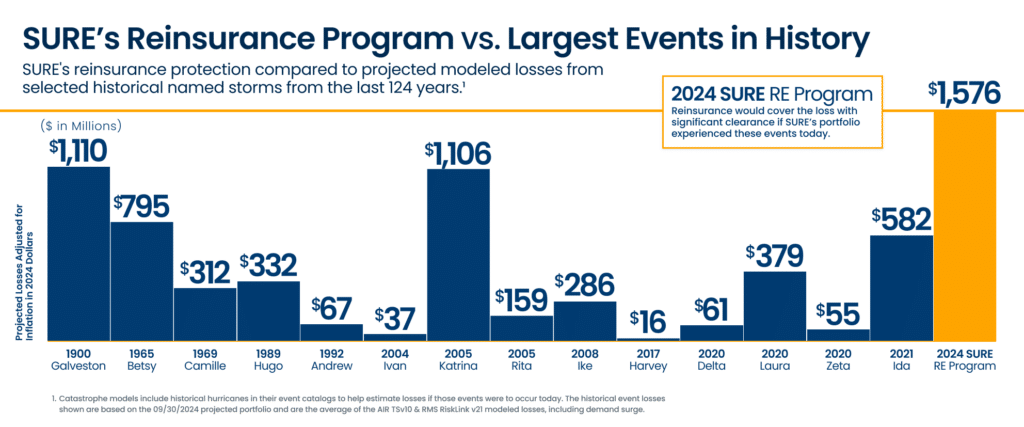

So what does our program look like in action? Take our first-event reinsurance for example. There’s less than a 1 percent probability of encountering an event that exceeds our program’s limits. The chart above illustrates how our reinsurance protection stacks up to our projected portfolio’s modeled losses from named storms in the last 124 years.

Extra Capital Reserves

As extra security beyond our reinsurance program, we have capital reserves to back up claims. SageSure, our underwriting partner, provided tens of millions in capital to fuel our growth and is committed to supporting our ongoing success.

Our policyholders’ premiums are the first line of defense for paying claims, but because we’re a reciprocal, policyholders also contribute a small yearly amount (called surplus contributions) that provides extra cushion to bolster our reserves. We’ve been growing fast as more customers choose us to protect their homes, and we have tens of millions in surplus to cover claims and maintain our operations plus adequate capital to support our continued growth.

Quarterly Financial Summary

We believe in transparency in everything we do, so check back here for a regularly updated look at our financial progress. Our assets and surplus are proof of our financial reserves beyond our reinsurance program. Learn more about our financial summary here.

Reporting Period: 6/30/24

Join Us

Today

Connect with our local agents to get a quote, or partner with SageSure to get exclusive access to SURE products for your clients.